|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best HELOC Rates in TN: A Comprehensive GuideFinding the best Home Equity Line of Credit (HELOC) rates in Tennessee can be a daunting task, especially with the varying offers from different lenders. This guide will help you navigate the options available and provide tips on securing the best rates. Understanding HELOCsA HELOC is a revolving line of credit that allows homeowners to borrow against the equity in their home. It provides flexibility and can be a great option for those needing access to funds for home improvements, debt consolidation, or other expenses. How HELOCs WorkHELOCs function similarly to credit cards. You have a set credit limit and can borrow as much or as little as you need, up to the limit, during the draw period. Payments are usually interest-only during this time. Factors Affecting HELOC Rates

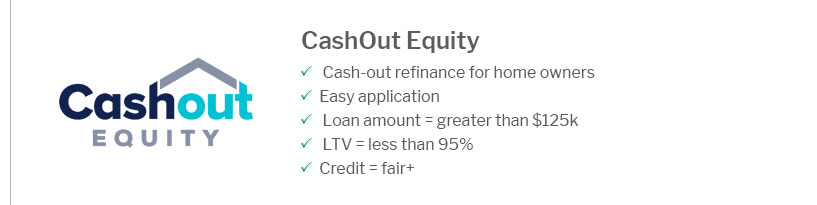

Top Lenders Offering HELOCs in TennesseeWhile there are numerous financial institutions offering HELOCs in Tennessee, some stand out due to competitive rates and customer service. Consider checking with local banks and credit unions as they often offer personalized services. Comparing Lender Offers

For those interested in broader financial options, exploring the 3 step harp refinance program can provide additional insights into refinancing opportunities. Tips for Securing the Best HELOC RatesHere are some strategies to ensure you get the best possible HELOC rates: Improve Your Financial ProfileMaintaining a good credit score and a low debt-to-income ratio are crucial steps. Regularly monitoring your credit report can help identify areas for improvement. Negotiate with LendersDon’t hesitate to negotiate terms with potential lenders. Many are willing to offer better rates to attract business, especially if you have a strong credit history. Consider the TimingInterest rates fluctuate, so timing your application during periods of lower rates can save money over the life of the loan. Keeping an eye on mortgage interest rates 30 can provide insights into trends that affect HELOC rates. FAQs

https://www.bankrate.com/home-equity/heloc-rates/

Your potential HELOC rate also depends on where your home is located. As of Mar. 26, 2025, the current average HELOC interest rate in the 10 largest U.S. ... https://www.leaderscu.com/home-loans/heloc

Home Equity Loan rates are calculated at Prime plus a margin. Margins remain the same for the life of the loan and can range from 0.25% APR - 6% APR. APR is ... https://www.erate.com/home-equity/tennessee/home-equity-line-of-credit

1. APRs for initial advances range from 6.3% to 18.00% based on funded HELOCs as of September 2024. Your actual rate will depend on many factors such as your ...

|

|---|